Fintech, When this word comes in our mind we assumed big pictures like FinTech is future, Upcoming Unicorn will be from FinTech, FinTech is Fastest Growing, FinTech catching most VC’s (Venture Capitalist) and Etc. Anyway all things which comes in our mind is true as per research, traction and technology.

We as a Fintech Enthusiast seen few FinTech Startup companies growing superfast in term of user acquisition through burning huge VC’s money (Cash Burn).

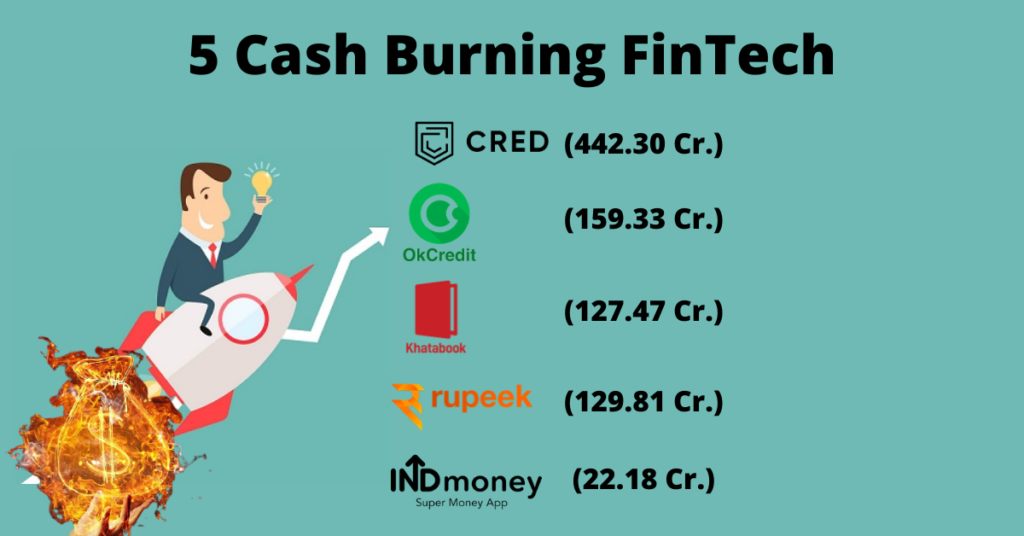

- CRED (442.3 Cr.)

- OkCredit (159.33 Cr.)

- KhataBook (127.47 Cr.)

- Rupeek (129.81 Cr.)

- INDMoney (22.18 Cr.)

Let’s see one by one

CRED

Cred (Kunal Shah Founded) a so called unique (Self Claimed) platform for paying credit card bills, Ohh!! I have mentioned so called unique, Sorry for this word but I mentioned this because I found several platform which was offering credit card bill payment before CRED. We can see this facility is available in PayTm, BillDesk before CRED.

CRED is unique in a way that they are focusing on credit card bill payment and giving huge money back to user. If this called unique then they are unique.

CRED Financial-

WOW!! 442.3 Cr expense just for earning 0.52 Cr, What a great startup!! Hey Cool.. I know revenue is not only parameter to measure success of any startup (Brand Value, Consumer Retention and Etc.) rest you guys can understand.

Anyway let’s see other data, Till now they are having 5.9Mn user base, lets assume 90%+ are regular user (Hypothetical Assumption) who is using CRED 4-5 times in a month for their bill payment.

As per Kunal Shah his platform CRED is having 20% share of credit card bill payment.

Till now CRED raised $256.5Mn (1855 Cr. money burning will continue…) even $1.2Mn (9 Cr.) for ESOP buyback this great because by this employee get benefits very early, I think this can a record of any startup for buyback.

Let’s forget about data, over all cred in a platform which is dealing in embedded finance by these steps-

Pay Credit Card Bills >> Get Coupon >> Do Shopping From Affiliate Websites

(Affiliate Marketing Commission, Hey! Digital Marketers chill and don’t think you can become a billion dollar startup by affiliate marketing).

References:

- https://entrackr.com/2021/02/kunal-shahs-cred-spent-rs-727-to-earn-a-rupee-in-fy20/

- https://www.finextra.com/newsarticle/37205/indian-startup-cred-raises-81-million

- https://www.financialexpress.com/industry/sme/kunal-shahs-credit-card-payment-app-cred-completes-rs-9-cr-esop-buyback-programme-with-series-c-funding/2163816/

OkCredit

An app for Managing Daily Accounting Book (Accounting) digitally. This company didn’t ever mentioned that they are unique.

OkCredit Financial

WOW! 159.33 Cr spends for NIL revenue. What a fabulous startup, Anyway as previously mentioned that revenue is not an parameter for success of any startup.

Currently OkCredit have 5.5Mn user base and in the month of Oct 20 they recorded $7.5Bn worth of transection which is approx. 54,739Cr. rupees. This is really a big number.

Till now OkCredit received $84.2Mn funding in multiple round and latest company valuation is $150Mn (Unconfirmed). Also as per Entrackr sources claim OkCredit have in talk for merger and acquisition which shows they are not in race for burning money.

References:

- https://entrackr.com/2021/01/okcredits-losses-soar-88x-to-rs-156-cr-with-zero-operating-revenue-in-fy20/

- https://gadgets.ndtv.com/apps/news/indian-startups-101-okcredit-ceo-co-founder-harsh-pokharna-all-you-need-to-know-2371657

- https://entrackr.com/2019/09/exclusive-okcredit-talks-to-raise-60-mn-tiger-global/

- https://entrackr.com/2020/10/exclusive-okcredit-explores-ma-opportunities/

Pic Credit: Entrackr

KhataBook

A Big name in FinTech field which digitalizing accounting of small shop owner to small businesses, with this app shops, small business can get digitalized. Khatabook is doing phenomenal work and also gained good number of business owner at there platform.

Khatabook total raised $111.5 Mn. from various VC’s in which few of them mentioning below-

- Surge

- Sequoia

- Kunal Shah and Etc.

KhataBook Financial

Again a WOW moment because they have burned 127.47 Cr. for generating NIL revenue. Really a big startup. Still I’m in confusion that they are going to be a billion dollar company.

Till now KhataBook have 8+ Mn active userbase and 20+ Mn registered userbase and KhataBook is available in 11 Languages.

References:

- https://entrackr.com/2021/02/khatabook-lost-rs-126-cr-with-zero-revenue-in-fy20/

- https://gadgets.ndtv.com/apps/features/indian-startups-101-khatabook-ceo-ravish-naresh-all-you-need-to-know-2330036

- https://www.crunchbase.com/organization/khatabook

Rupeek

Rupeek again a well know FinTech startup for Lending Against Gold. Rupeek specialized itself in Gold Loan and operating in 25 city. In my view Rupeek really providing best service to those consumer who is looking for Gold Loan.

Rupeek is official business correspondent for few banks like ICICI Bank, Federal Bank, Karur Vysya Bank for Gold Loan.

Rupeek till now raised $60Mn from various well known VC’s like-

- Accel,

- Sequoia Capital India and Etc.

Rupeek Financial

Since Last 2 year Rupeek Burned 129.81 Cr. for generating revenue of 29.83 Cr. again a big loss.

References:

- https://entrackr.com/2021/02/rupeeks-topline-grew-4-7x-to-rs-32-cr-while-losses-surged-to-rs-77-cr-in-fy20/

- https://www.crunchbase.com/funding_round/rupeek-series-c–767fd33c

INDMoney

INDMoney a super money app which is again from a well known founder Ashish Kashyap (Founder of Goibibo and PayU India). As per various reports this is under next billion dollar startup. INDMoney is trying to provide all financial things under one app. We can see lot’s of things in this app.

I personally feel this is nice app for finance management but still this app need lot’s of improvement.

But it’s not a matter what I feel, Till now INDMoney have 500K+ downloads.

INDMoney is offering several financial services which mentioned below-

- Investment

- Loans

Till now INDMoney have raised $56.9Mn from various top VC’s in which few name is mentioned below-

- StedView

- Tiger Global

INDMoney Financial

INDMoney Burned 22.18 Cr. for generating a revenue of 10.43 Cr. and it’s shocking for me, As I was expecting this is a startup which should not be in this list, I can say this because, I have also worked on same business model.

References:

- https://entrackr.com/2020/12/indmoney-spent-rs-19-cr-to-earn-rs-1-07-cr-in-operating-revenue-in-fy20/

- https://www.crunchbase.com/organization/indwealth

- https://yourstory.com/2020/01/funding-startup-indwealth-tiger-global-series-c-round

Conclusion:

After seeing this data I’m shocked, I’m totally blank when I see big people is spending money for user acquisition and it’s not only user acquisition they are burning huge money for user retention or engagement.

I’m seeing since last 5 year and witnessed lot’s of good startup were get closed just because of lack of fund. I have few questions which mentioning below-

- Is this really an ideal startup eco system?

- Can a person start a business in lack of funding? (I know few people give lot’s of example)

- Is this right way of business?

Just think..

Thanks for reading.